Capital Raising & Investment Diligence

Fundraising & Investment Diligence

What we do

Deal Sourcing and Lead Generation

Find potential investors, acquirers, strategic partners and acquisition targets. From strategic players and family offices to Private Equity and Venture Capital firms, we identify, screen, and evaluate prospective investors and investment opportunities.

Investor and Company Outreach

Lead outreach process for investors, identifying investment opportunities and maximizing returns. For companies seeking investments, locating fitting investors and leading introductions to secure meetings and obtain direct funding.

Managing Road Shows & Investor Presentations

Lead introductions, manage meetings and lead presentations to groups of potential investors. Create clear and compelling investor materials to clearly articulate value proposition and engage investors' interest.

Full Company Due Diligence

For investors, perform due diligence, assess revenue growth and cost reduction opportunities to determine a target’s full potential and provide a clear post-acquisition agenda. For firms seeking funding, manage due diligence processes for engaging with investors and raising funds.

Financial Modeling & Valuation

We help our clients with investments, financial transactions, strategic planning and operational analysis. Build efficient and robust models that underpin transaction values, assist with critical decisions and support productive teams.

Market Research & Competitive Analysis

Know your market and gain on the competition. Develop a defensive strategy and identify actionable opportunities to capture market share.

Portfolio Value Creation & Portfolio Company Oversight

We develop a strategic blueprint and align management on priorities to grow sales and reduce costs. We help companies establish a value-creation plan, develop milestones, track performance, and evaluate returns.

Exit Planning

Optimizing your exit is critical to realizing a competitive return. We conduct a top down analysis to refine divesture options and maximize the capital returned to you and your investing partners.

Funding Trends & Competitive Investors Activity

Whether you’re an investor searching for deals or an entrepreneur actively fundraising, understand the direction of PE/VC Investor sentiment within specific industries, regional markets, and market segments.

Capital Raising

AlphaVate advises growth companies across stages and helps companies create the right strategies to raise funds, manage diligence processes, take advantage of strategic opportunities, and maximize organizational value. There are several scenarios where we can add value:

-

You’re trying to find investors that fit your organization

-

You’re looking to maximize value as part of a raise

-

You need to negotiate terms and manage the investment process

-

Your firm needs to accelerate growth

Deal Sourcing & Portfolio Value Creation

AlphaVate helps clients make wiser investments by identifying industry trends and uncovering new assets. AlphaVate sources investments, performs extensive due diligence, evaluates a targets’ revenue growth and cost reduction opportunities. By understanding the post-acquisition opportunities up front, investors are able to determine a target’s full potential, prepare a clear post-acquisition agenda, and determine how to allocate capital and what improvements will drive returns.

Due Diligence

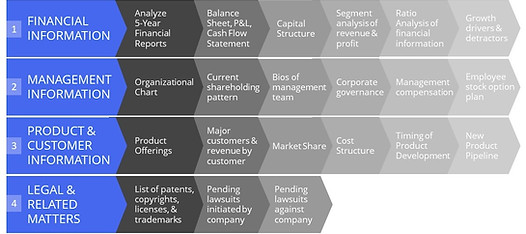

Due Diligence Checklist

AlphaVate helps companies address due diligence efforts by conducting the quantitative and qualitative research necessary to arrive at a valuation which properly reflects the real prospective asset’s worth. By conducting a deep dive into all aspects of an investment decision, investors and executive managers are able to evaluate viability of the operating model, and obtain the desired value from a deal.